Is Mold Covered by Your Homeowners Insurance?

10/5/2018 (Permalink)

Most owners insurance comes down to the source of the moisture to where the mold damage started. If you are unsure if your homeowners insurance covers mold, go over your policy. Make sure you look for mold exclusions or limitations and call your agent if it still unclear.

If mold results from a sudden and accidental damage, like a pipe bursting, the cost of mold remediation would be covered. Now, if it mold shows up because of neglecting home maintenance then most claims would be rejected.

Here is sample of damage done by an inch of flood water:

- Replace carpet, flooring: $2,700

- New baseboard molding: $2,250

- Replace drywall $1,350

- Cleanup, materials: $1,000

- Bookshelves, lamps: $500

- Total: $7,800

Source: National Flood Insurance Program - https://www.fema.gov/national-flood-insurance-program

You could also buy a mold rider as an add-on to your existing policy for extra coverage. If your insurance carrier doesn’t provide a rider, specialty companies might sell you a stand alone mold policy. Just to warn you, there will be a big price tag for that route.

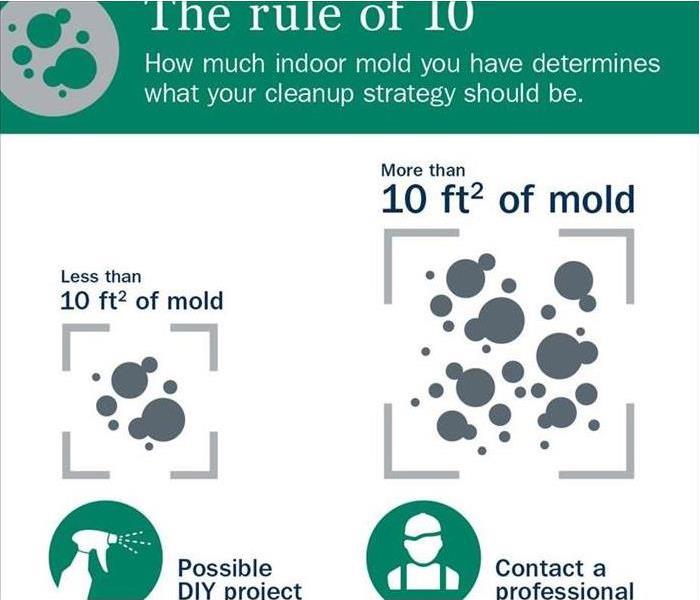

If your insurance does not cover mold at all, moisture prevention is the key.

To help prevent mold growth, take the following steps:

- Lower indoor humidity with air conditioners, de-humidifiers, and exhaust fans

- Inspect hoses and fittings on appliances, sinks, and toilets

- Use household cleaners with mold-killing ingredients like bleach

- Opt for paints and primes that contain mold inhibitors

- Clean gutters to avoid overflow and check roof for leaks

- Avoid carpet in wet areas like basements and bathrooms

- Remove and dry carpet, padding, and upholstery within 48 hours of flooding

Source: House logic https://www.houselogic.com/finances-taxes/home-insurance/homeowners-insurance-mold-covered/

24/7 Emergency Service

24/7 Emergency Service